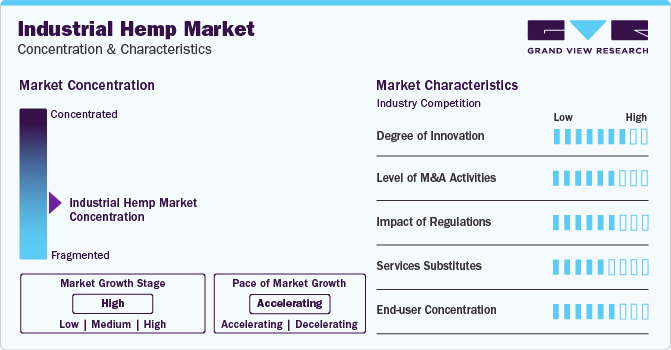

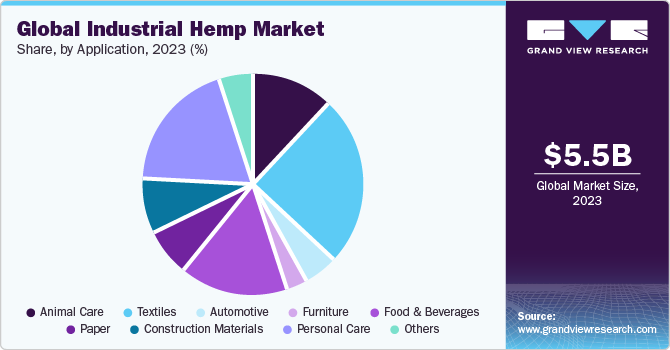

The global industrial hemp market size was estimated at USD 5.49 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 17.5% from 2024 to 2030. The growth is driven by the rising product demand from application industries, such as food & beverage, personal care, and animal care, across the globe.

Growing demand for hemp products including fiber, seed, stalks, hurds, and oils from the aforementioned application industries is expected to drive market growth. Industrial hemp production is associated with several agricultural and environmental benefits. With its fast growth period of 120-150 days and significant biomass yield, hemp enables efficient use of agricultural land. It is useful in carbon sequestration as it yields a large amount of biomass along with providing a useful break in crop rotation.

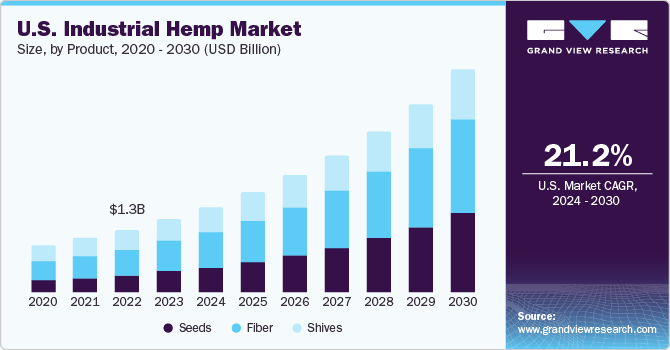

Market growth stage is high, and pace of the market growth is accelerating. The market is highly competitive owing to the presence of large number of domestic and international players operating in the industrial hemp market. The potential for growth in industrial hemp production and processing, fueled by the growing demand from key application industries, including personal care, food, hemp CBD, consumer textiles, and many others, is expected to drive the market over the forecast period. Increasing research & development activities to develop new genetically enhanced industrial hemp products and variants capable of offering higher yields and improved product quality are expected to have a positive impact on commercial industrial hemp production.

The cultivation of industrial hemp has been illegal for a number of years in many countries, necessitating complete re-establishment of the supply chain while achieving economies of scale. The profitability of hemp production is speculative at present and does not include additional costs of growing hemp in regulated markets such as the costs of licensing, monitoring, and verification. However, expansion of market opportunities with the liberalization of regulations on cultivation, processing, transportation, and the use of industrial hemp is expected to drive the market growth over the forecast period.

The market is expected to witness a low threat of substitutes owing to the presence of limited number of industrial hemp products that have characteristics similar to industrial hemp for use in different applications. However, products such as chia and flax seeds have nutritional value as high as hemp seeds. This is anticipated to result in moderate threat of substitution in the market.

The global market growth is driven by the rising demand from industries, such as personal care, recycling, agriculture, automotive, textiles, furniture, food & beverage, paper, and construction materials. The increasing product usage in different end-use industries has resulted in increased cultivation and trading of hemp in the global market. China has emerged as a significant producer and exporter of industrial hemp followed by Canada and France. The increasing use of hemp in textile and medical applications is expected to significantly propel the demand for industrial hemp in the global market. However, the production of industrial hemp and its products faces several obstacles owing to the presence of stringent government drug policies and concerns about the impact these products on the illegal marijuana market.

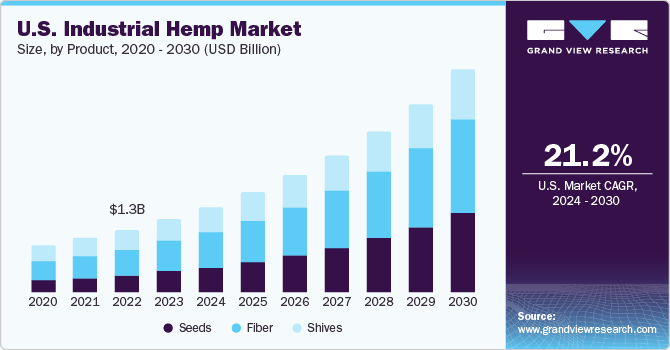

The U.S. is heavily investing in developing different varieties of industrial hemp with THC content of less than 0.3% on account of the rising demand from different application industries. The Government of the U.S. announced a COVID-19 relief stimulus of USD 1.9 trillion in January 2021, which helped in the market recovery. Moreover, the steady growth of small market players in hemp-based industrial and consumer products is anticipated to drive the U.S. market over the forecast period.Growing awareness regarding the dietary advantages of hempseed and hempseed oil, along with high demand from the cosmetics and personal care industries, will support market growth. Rising production of soaps, shampoo, bath gels, hand and body lotions, UV skin protectors, massage oils, and a range of other hemp-based products is expected to have a major impact on market growth.

High nutritional values and beneficial fatty acid and protein profiles of hemp are driving the demand for hemp products. High absorbency of hemp fiber is beneficial for livestock bedding, oil & gas cleanup, and the personal hygiene market. In addition, increasing product demand in textile, paper, and building materials markets is growing owing to its favorable acoustic and aesthetic properties. The products manufactured from hemp are eco-friendly, renewable, and associated with less harmful methods of preparation. Paper produced from hemp fiber requires fewer chemicals for processing as compared to paper produced from wood pulps. Thus, the rising awareness about product benefits is projected boost market growth.

The hemp seeds product segment led the market and accounted for more than 29.97% revenue share of the global revenue in 2023. Hemp seeds are gaining popularity in food and nutraceutical markets to obtain seed, oil, and food matter. Rising use of hemp oil seed in lotions, shampoos, soaps, bath gels, and cosmetics, further benefits market growth. Hemp seeds are widely used in the production of oil, which is utilized in personal care, food & beverages, and animal feed industries. In addition, oil is used in nutritional supplements and medicinal & therapeutic products, such as pharmaceuticals. The market for seeds is expected to grow over the forecast period on account of rising demand from application industries.

Hemp fibers are used in paper, carpeting, home furnishing, construction materials, insulation materials, auto parts, and composites. Insulation materials and bio-composites consume a significant amount of hemp fibers on account of their lightweight, superior strength, biodegradability, and thermodynamic properties. Hemp shivs cost half the value of fibers and have several applications in different industries, which is expected to drive market growth over the forecast period. Hemp shivs are majorly used in animal bedding materials on account of their high absorbance ability, which is around four times its dry weight.

The textile application segment led the market in 2023. Hemp fabric is strong, hypo-allergic, and naturally resistant to UV light, mold, and mildew, which represents an added advantage over other fabrics. In addition, it can be blended with cotton or linen, which adds stretch and strength to the fabric. Hemp seeds are rich in protein content and majorly used as birdseed and animal feed. Bird and fish feed are important markets for hemp seeds in animal nutrition. Fish and birds need fatty acids with a high share of omega-3 and omega-6 fatty acids for optimum development, hence consume hemp seeds. Growing product demand in the animal care industry is likely to fuel overall market growth.

Hemp oil is widely used in the manufacturing of food & beverages on account of its high nutritional content, including fatty acids, proteins, and several other ingredients. Several food manufacturing processes make use of hemp seeds and oil, which is expected to propel market growth. In addition, rising consumer awareness about the product’s benefits is likely to fuel market’s growth. This product is increasingly used in insulation and construction materials, such as fiberboard, cement blocks, putty, stucco and mortar, coatings, and other products as a fiberglass substitute. Construction materials using industrial hemp also include roofing underlay, acoustic materials, pipe wraps, house wraps, and shingles.

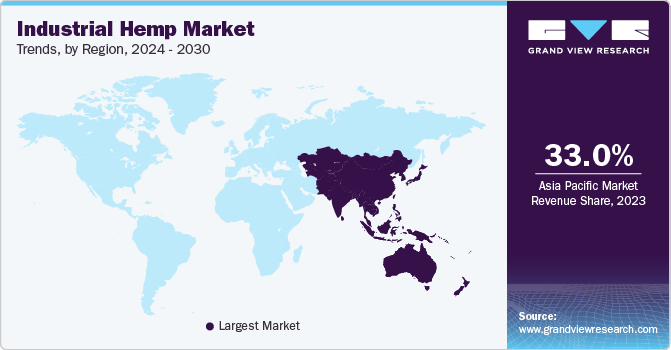

Asia Pacific is one of the major consumers of industrial hemp and accounted for a revenue share of more than 33% in 2023. Economies, such as China, India, Japan, Korea, Australia, New Zealand, and Thailand, are actively involved in the production and consumption of industrial hemp and products, such as fiber, seed, hurds, and oil. Increasing global product demand along with advancing technologies and innovation are making harvesting easier for cultivators, thereby changing the face of hemp production in the region. Increasing consumption of hemp-based food products and supplements in developing economies with a growing geriatric population is expected to drive market growth.

North America is a major product consumer. These products are consumed in different application industries. High consumer disposable income, growing aging population, and rising concerns related to skin diseases and UV protection are expected to drive the demand for hemp oil in the personal care industry in this region. Industrial hemp in Europe is majorly consumed in automotive parts, construction materials, textiles, and fabrics in the form of fibers. However, growing demand for hemp oil in the food & supplements, cosmetics, and personal care markets is expected to drive market growth.

Industry players produce large-quantity and high-quality industrial hemp along with a wide range of variants, in terms of seed size and oil composition. Potential yields and processing methods, technologies used for processing, along with the cost of production and returns, play a major role in driving the competition in the industry. Industrial hemp companies are focusing on increasing product cultivation and processing facilities in economies where the plant can be grown legally. Major industry players are investing heavily in R&D activities to achieve high yields from cultivation. These players offer diverse varieties of hemp-derived products and can penetrate large markets.

Report Attribute

Details

Market size value in 2024

USD 6.3 billion

Revenue forecast in 2030

USD 16.82 billion

Growth rate

CAGR of 17.5% from 2024 to 2030

Volume in tons, revenue in USD million/billion, and CAGR from 2024 to 2030

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Product, Source, application, and region

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

U.S.; Canada; Germany; U.K.; France; China; India; Japan; Brazil

Key companies profiled

Parkland Industrial Hemp Growers Cooperative Ltd.; CBD Biotechnology Co.; Botanical Genetics, LLC; Marijuana Company of America Inc.; HempMeds Brasil; Terra Tech Corp.; American Cannabis Company, Inc.; HempFlax B.V.; Industrial Hemp Manufacturing, LLC; American Hemp; Hemp, Inc.; Boring Hemp Company; Plains Industrial Hemp Processing Ltd.; Ecofiber; Industries Operations; Valley Bio Ltd.

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

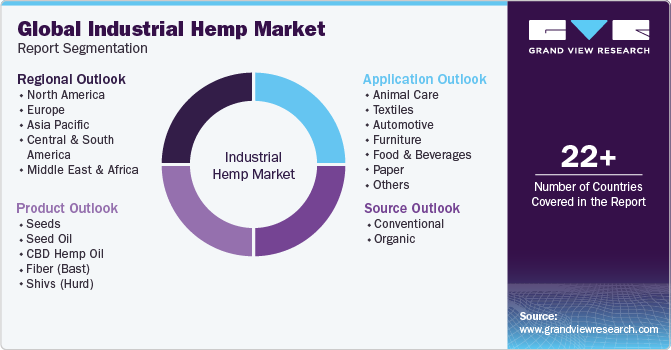

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the industrial hemp market report based on product, source,application, and region:

b. The global industrial hemp market size was estimated at USD 5.49 billion in 2023 and is expected to reach USD 6.3 billion in 2024.

b. The global industrial hemp market is expected to grow at a compound annual growth rate of 17.5% from 2024 to 2030 to reach USD 116.82 billion by 2030.

b. North America dominated the industrial hemp market with a share of 33.9% in 2023, owing to rising production and consumption of industrial hemp in the region coupled with the presence of well-established market players with robust supply chains.

b. Some key players operating in the industrial hemp market include Parkland Industrial Hemp Growers Cooperative Ltd., CBD Biotechnology Co., Botanical Genetics, LLC, Marijuana Company of America Inc., and HempMeds Brasil.

b. Key factors that are driving the market growth include rising demand from the application industries coupled with agricultural and environmental product benefits.

Request a Free Sample

Table of Contents

Chapter 1. Industrial Hemp Market: Methodology and Scope

1.1. Market Segmentation & Scope

1.2. Market Definition

1.3. Information Procurement

1.3.1. Purchased Database

1.3.2. GVR’s Internal Database

1.3.3. Secondary Sources & Third-Party Perspectives

1.3.4. Primary Research

1.4. Information Analysis

1.4.1. Data Analysis Models

1.5. Market Formulation & Data Visualization

1.6. Data Validation & Publishing

Chapter 2. Industrial Hemp Market: Executive Summary

2.1. Market Outlook

2.2. Segmental Outlook

2.3. Competitive Insights

Chapter 3. Industrial Hemp Market: Variables, Trends & Scope

3.1. Ancillary Market Outlook

3.2. Industry Value Chain Analysis

3.3. Manufacturing Process

3.4. Regulatory Framework

3.5. Industrial Hemp - Market Dynamics

3.5.1. Market Driver Analysis

3.5.2. Market Restraint Analysis

3.5.3. Industry Challenges

3.6. Business Environment Analysis: Industrial Hemp Market

3.6.1. Porter's Analysis

3.6.1.1. Supplier Power

3.6.1.2. Buyer Power

3.6.1.3. Substitution Threat

3.6.1.4. Threat from New Entrant

3.6.1.5. Competitive Rivalry

3.6.2. PESTEL Analysis

3.6.2.1. Political Landscape

3.6.2.2. Environmental Landscape

3.6.2.3. Social Landscape

3.6.2.4. Technology Landscape

3.6.2.5. Economic Landscape

3.6.2.6. Legal Landscape

Chapter 4. Industrial Hemp Market: Product Estimates & Trend Analysis

4.1. Industrial Hemp Market: Product Movement Analysis, 2023 & 2030

4.2. Seeds

4.2.1. Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

4.3. Seed Oil

4.3.1. Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

4.4. CBD Hemp Oil

4.4.1. Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

4.5. Fiber (Bast)

4.5.1. Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

4.6. Shivs (Hurd)

4.6.1. Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

Chapter 5. Industrial Hemp Market: Source Estimates & Trend Analysis

5.1. Industrial Hemp Market: Source Movement Analysis, 2023 & 2030

5.2. Conventional

5.2.1. Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

5.3. Organic

5.3.1. Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

Chapter 6. Industrial Hemp Market: Application Estimates & Trend Analysis

6.1. Industrial Hemp Market: Application Movement Analysis, 2023 & 2030

6.2. Animal Care

6.2.1. Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

6.3. Textiles

6.3.1. Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

6.4. Automotive

6.4.1. Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

6.5. Furniture

6.5.1. Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

6.6. Food & Beverages

6.6.1. Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

6.7. Paper

6.7.1. Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

6.8. Construction Materials

6.8.1. Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

6.9. Personal Care

6.9.1. Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

6.10. Others

6.10.1. Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

Chapter 7. Industrial Hemp Market: Regional Estimates & Trend Analysis

7.1. Industrial Hemp Market: Regional Movement Analysis, 2023 & 208

7.2. North America

7.2.1. North America Industrial Hemp Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

7.2.2. North America Industrial Hemp Market Estimates and Forecasts, By Source, 2018 - 2030 (Tons) (USD Million)

7.2.3. North America Industrial Hemp Market Estimates and Forecasts, By Product, 2018 - 2030 (Tons) (USD Million)

7.2.4. North America Industrial Hemp Market Estimates and Forecasts, By Application, 2018 - 2030 (Tons) (USD Million)

7.2.5. U.S.

7.2.5.1. U.S. Industrial Hemp Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

7.2.5.2. U.S. Industrial Hemp Market Estimates and Forecasts, By Source, 2018 - 2030 (Tons) (USD Million)

7.2.5.3. U.S. Industrial Hemp Market Estimates and Forecasts, By Product, 2018 - 2030 (Tons) (USD Million)

7.2.5.4. U.S. Industrial Hemp Market Estimates and Forecasts, By Application, 2018 - 2030 (Tons) (USD Million)

7.2.6. Canada

7.2.6.1. Canada Industrial Hemp Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

7.2.6.2. Canada Industrial Hemp Market Estimates and Forecasts, by Source, 2018 - 2030 (Tons) (USD Million)

7.2.6.3. Canada Industrial Hemp Market Estimates and Forecasts, by product, 2018 - 2030 (Tons) (USD Million)

7.2.6.4. Canada Industrial Hemp Market Estimates and Forecasts, by application, 2018 - 2030 (Tons) (USD Million)

7.2.7. Mexico

7.2.7.1. Mexico Industrial Hemp Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

7.2.7.2. Mexico Industrial Hemp Market Estimates and Forecasts, by Source, 2018 - 2030 (Tons) (USD Million)

7.2.7.3. Mexico Industrial Hemp Market Estimates and Forecasts, by product, 2018 - 2030 (Tons) (USD Million)

7.2.7.4. Mexico Industrial Hemp Market Estimates and Forecasts, by application, 2018 - 2030 (Tons) (USD Million)

7.3. Europe

7.3.1. Europe Industrial Hemp Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

7.3.2. Europe Industrial Hemp Market Estimates and Forecasts, By source, 2018 - 2030 (Tons) (USD Million)

7.3.3. Europe Industrial Hemp Market Estimates and Forecasts, By Product, 2018 - 2030 (Tons) (USD Million)

7.3.4. Europe Industrial Hemp Market Estimates and Forecasts, By Application, 2018 - 2030 (Tons) (USD Million)

7.3.5. UK

7.3.5.1. UK Industrial Hemp Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

7.3.5.2. UK Industrial Hemp Market Estimates and Forecasts, By source, 2018 - 2030 (Tons) (USD Million)

7.3.5.3. UK Industrial Hemp Market Estimates and Forecasts, By Product, 2018 - 2030 (Tons) (USD Million)

7.3.5.4. UK Industrial Hemp Market Estimates and Forecasts, By Application, 2018 - 2030 (Tons) (USD Million)

7.3.6. Germany

7.3.6.1. Germany Industrial Hemp Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

7.3.6.2. Germany Industrial Hemp Market Estimates and Forecasts, By source, 2018 - 2030 (Tons) (USD Million)

7.3.6.3. Germany Industrial Hemp Market Estimates and Forecasts, By Product, 2018 - 2030 (Tons) (USD Million)

7.3.6.4. Germany Industrial Hemp Market Estimates and Forecasts, By Application, 2018 - 2030 (Tons) (USD Million)

7.3.7. France

7.3.7.1. France Industrial Hemp Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

7.3.7.2. France Industrial Hemp Market Estimates and Forecasts, By Source, 2018 - 2030 (Tons) (USD Million)

7.3.7.3. France Industrial Hemp Market Estimates and Forecasts, By Product, 2018 - 2030 (Tons) (USD Million)

7.3.7.4. France Industrial Hemp Market Estimates and Forecasts, By Application, 2018 - 2030 (Tons) (USD Million)

7.3.8. Italy

7.3.8.1. Italy Industrial Hemp Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

7.3.8.2. Italy Industrial Hemp Market Estimates and Forecasts, By source, 2018 - 2030 (Tons) (USD Million)

7.3.8.3. Italy Industrial Hemp Market Estimates and Forecasts, By Product, 2018 - 2030 (Tons) (USD Million)

7.3.8.4. Italy Industrial Hemp Market Estimates and Forecasts, By Application, 2018 - 2030 (Tons) (USD Million)

7.3.9. Spain

7.3.9.1. Spain Industrial Hemp Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

7.3.9.2. Spain Industrial Hemp Market Estimates and Forecasts, By source, 2018 - 2030 (Tons) (USD Million)

7.3.9.3. Spain Industrial Hemp Market Estimates and Forecasts, By Product, 2018 - 2030 (Tons) (USD Million)

7.3.9.4. Spain Industrial Hemp Market Estimates and Forecasts, By Application, 2018 - 2030 (Tons) (USD Million)

7.3.10. The Netherlands

7.3.10.1. The Netherlands Industrial Hemp Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

7.3.10.2. The Netherlands Industrial Hemp Market Estimates and Forecasts, By Source, 2018 - 2030 (Tons) (USD Million)

7.3.10.3. The Netherlands Industrial Hemp Market Estimates and Forecasts, By Product, 2018 - 2030 (Tons) (USD Million)

7.3.10.4. The Netherlands Industrial Hemp Market Estimates and Forecasts, By Application, 2018 - 2030 (Tons) (USD Million)

7.4. Asia Pacific

7.4.1. Asia Pacific Industrial Hemp Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

7.4.2. Asia Pacific Industrial Hemp Market Estimates and Forecasts, By Source, 2018 - 2030 (Tons) (USD Million)

7.4.3. Asia Pacific Industrial Hemp Market Estimates and Forecasts, By Product, 2018 - 2030 (Tons) (USD Million)

7.4.4. Asia Pacific Industrial Hemp Market Estimates and Forecasts, By Application, 2018 - 2030 (Tons) (USD Million)

7.4.5. China

7.4.5.1. China Industrial Hemp Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

7.4.5.2. China Industrial Hemp Market Estimates and Forecasts, By Source, 2018 - 2030 (Tons) (USD Million)

7.4.5.3. China Industrial Hemp Market Estimates and Forecasts, By Product, 2018 - 2030 (Tons) (USD Million)

7.4.5.4. China Industrial Hemp Market Estimates and Forecasts, By Application, 2018 - 2030 (Tons) (USD Million)

7.4.6. India

7.4.6.1. India Industrial Hemp Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

7.4.6.2. India Industrial Hemp Market Estimates and Forecasts, By Source, 2018 - 2030 (Tons) (USD Million)

7.4.6.3. India Industrial Hemp Market Estimates and Forecasts, By Product, 2018 - 2030 (Tons) (USD Million)

7.4.6.4. India Industrial Hemp Market Estimates and Forecasts, By Application, 2018 - 2030 (Tons) (USD Million)

7.4.7. Japan

7.4.7.1. Japan Industrial Hemp Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

7.4.7.2. Japan Industrial Hemp Market Estimates and Forecasts, By Source, 2018 - 2030 (Tons) (USD Million)

7.4.7.3. Japan Industrial Hemp Market Estimates and Forecasts, By Product, 2018 - 2030 (Tons) (USD Million)

7.4.7.4. Japan Industrial Hemp Market Estimates and Forecasts, By Application, 2018 - 2030 (Tons) (USD Million)

7.4.8. Australia

7.4.8.1. Australia Industrial Hemp Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

7.4.8.2. Australia Industrial Hemp Market Estimates and Forecasts, By Source, 2018 - 2030 (Tons) (USD Million)

7.4.8.3. Australia Industrial Hemp Market Estimates and Forecasts, By Product, 2018 - 2030 (Tons) (USD Million)

7.4.8.4. Australia Industrial Hemp Market Estimates and Forecasts, By Application, 2018 - 2030 (Tons) (USD Million)

7.4.9. New Zealand

7.4.9.1. New Zealand Industrial Hemp Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

7.4.9.2. New Zealand Industrial Hemp Market Estimates and Forecasts, By Source, 2018 - 2030 (Tons) (USD Million)

7.4.9.3. New Zealand Industrial Hemp Market Estimates and Forecasts, By Product, 2018 - 2030 (Tons) (USD Million)

7.4.9.4. New Zealand Industrial Hemp Market Estimates and Forecasts, By Application, 2018 - 2030 (Tons) (USD Million)

7.5. Central & South America

7.5.1. Central & South America Industrial Hemp Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

7.5.2. Central & South America Industrial Hemp Market Estimates and Forecasts, By Product, 2018 - 2030 (Tons) (USD Million)

7.5.3. Central & South America Industrial Hemp Market Estimates and Forecasts, By Source, 2018 - 2030 (Tons) (USD Million)

7.5.4. Central & South America Industrial Hemp Market Estimates and Forecasts, By Application, 2018 - 2030 (Tons) (USD Million)

7.5.5. Brazil

7.5.5.1. Brazil Industrial Hemp Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

7.5.5.2. Brazil Industrial Hemp Market Estimates and Forecasts, By Source, 2018 - 2030 (Tons) (USD Million)

7.5.5.3. Brazil Industrial Hemp Market Estimates and Forecasts, By Product, 2018 - 2030 (Tons) (USD Million)

7.5.5.4. Brazil Industrial Hemp Market Estimates and Forecasts, By Application, 2018 - 2030 (Tons) (USD Million)

7.6. Middle East & Africa

7.6.1. Middle East & Africa Industrial Hemp Market Estimates and Forecasts, 2018 - 2030 (Tons) (USD Million)

7.6.2. Middle East & Africa Industrial Hemp Market Estimates and Forecasts, By Source, 2018 - 2030 (Tons) (USD Million)

7.6.3. Middle East & Africa Industrial Hemp Market Estimates and Forecasts, By Product, 2018 - 2030 (Tons) (USD Million)

7.6.4. Middle East & Africa Industrial Hemp Market Estimates and Forecasts, By Application, 2018 - 2030 (Tons) (USD Million)

Chapter 8. Competitive Landscape

8.1. Competitive Landscape

8.2. Vendor Landscape

8.3. Competitive Environment

8.4. Competitive Market Positioning

8.5. Strategy Framework

8.6. Heat Map Analysis

8.7. List of Key Companies

Chapter 9. Company Profiles

9.1. Parkland Industrial Hemp Growers Cooperative Ltd. (PIHG)

9.1.1. Company overview

9.1.2. Financial performance

9.1.3. Product benchmarking

9.1.4. Strategic initiatives

9.2. CBD Biotechnology Co., Ltd.

9.2.1. Company overview

9.2.2. Financial performance

9.2.3. Product benchmarking

9.2.4. Strategic initiatives

9.3. Botanical Genetics, LLC

9.3.1. Company overview

9.3.2. Financial performance

9.3.3. Product benchmarking

9.3.4. Strategic initiatives

9.4. Marijuana Company of America Inc.

9.4.1. Company overview

9.4.2. Financial performance

9.4.3. Product benchmarking

9.4.4. Strategic initiatives

9.5. HempMeds Brasil

9.5.1. Company overview

9.5.2. Financial performance

9.5.3. Product benchmarking

9.5.4. Strategic initiatives

9.6. Terra Tech Corp

9.6.1. Company overview

9.6.2. Financial performance

9.6.3. Product benchmarking

9.6.4. Strategic initiatives

9.7. American Cannabis Company, Inc.

9.7.1. Company overview

9.7.2. Financial performance

9.7.3. Product benchmarking

9.7.4. Strategic initiatives

9.8. HempFlax B.V.

9.8.1. Company overview

9.8.2. Financial performance

9.8.3. Product benchmarking

9.8.4. Strategic initiatives

9.9. Industrial Hemp Manufacturing, LLC

9.9.1. Company overview

9.9.2. Financial performance

9.9.3. Product benchmarking

9.9.4. Strategic initiatives

9.10. American Hemp

9.10.1. Company overview

9.10.2. Financial performance

9.10.3. Product benchmarking

9.10.4. Strategic initiatives

9.11. Hemp, Inc.

9.11.1. Company overview

9.11.2. Financial performance

9.11.3. Product benchmarking

9.11.4. Strategic initiatives

9.12. Boring Hemp Company

9.12.1. Company overview

9.12.2. Financial performance

9.12.3. Product benchmarking

9.12.4. Strategic initiatives

9.13. Plains Industrial Hemp Processing Ltd.

9.13.1. Company overview

9.13.2. Financial performance

9.13.3. Product benchmarking

9.13.4. Strategic initiatives

9.14. Ecofiber

9.14.1. Company overview

9.14.2. Financial performance

9.14.3. Product benchmarking

9.14.4. Strategic initiatives

9.15. Valley Bio Limited

9.15.1. Company overview

9.15.2. Financial performance

9.15.3. Product benchmarking

9.15.4. Strategic initiatives

List of Tables

Table 1 List of state statutes and public acts on industrial hemp research and cultivation

Table 2 Industrial hemp seeds market estimates and forecasts, (Tons) (USD Million)

Table 3 Industrial hemp seed oil market estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 4 Industrial CBD hemp oil market estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 5 Industrial hemp fiber market estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 6 Industrial hemp shivs market estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 7 Industrial hemp market estimates and forecasts, by conventional source, 2018 - 2030 (Tons) (USD Million)

Table 8 Industrial hemp market estimates and forecasts, by organic source, 2018 - 2030 (Tons) (USD Million)

Table 9 Industrial hemp market estimates and forecasts in animal care, 2018 - 2030 (Tons) (USD Million)

Table 10 Industrial hemp market estimates and forecasts in textiles, 2018 - 2030 (Tons) (USD Million)

Table 11 Industrial hemp market estimates and forecasts in automotive, 2018 - 2030 (Tons) (USD Million)

Table 12 Industrial hemp market estimates and forecasts in furniture, 2018 - 2030 (Tons) (USD Million)

Table 13 Industrial hemp market estimates and forecasts in food & beverages, 2018 - 2030 (Tons) (USD Million)

Table 14 Industrial hemp market estimates and forecasts in paper, 2018-2018 - 20302030 (Tons) (USD Million)

Table 15 Industrial hemp market estimates and forecasts in construction materials, 2018 - 2030 (Tons) (USD Million)

Table 16 Industrial hemp market estimates and forecasts in personal care, 2018 - 2030 (Tons) (USD Million)

Table 17 Industrial hemp market estimates and forecasts in other applications, 2018 - 2030 (Tons) (USD Million)

Table 18 North America industrial hemp market volume and revenue estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 19 North America industrial hemp market volume estimates and forecasts, by source, 2018 - 2030 (Tons)

Table 20 North America industrial hemp market revenue estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 21 North America industrial hemp market volume estimates and forecasts, by product, 2018 - 2030 (Tons)

Table 22 North America industrial hemp market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 23 North America industrial hemp market volume estimates and forecasts, by application, 2018 - 2030 (Tons)

Table 24 North America industrial hemp market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 25 U.S. industrial hemp market volume and revenue estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 26 U.S. industrial hemp market volume estimates and forecasts, by source, 2018 - 2030 (Tons)

Table 27 U.S. industrial hemp market revenue estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 28 U.S. industrial hemp market volume estimates and forecasts, by product, 2018 - 2030 (Tons)

Table 29 U.S. industrial hemp market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 30 U.S. industrial hemp market volume estimates and forecasts, by application, 2018 - 2030 (Tons)

Table 31 U.S. industrial hemp market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 32 Canada industrial hemp market volume and revenue estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 33 Canada industrial hemp market volume estimates and forecasts, by source, 2018 - 2030 (Tons)

Table 34 Canada industrial hemp market revenue estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 35 Canada industrial hemp market volume estimates and forecasts, by product, 2018 - 2030 (Tons)

Table 36 Canada industrial hemp market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 37 Canada industrial hemp market volume estimates and forecasts, by application, 2018 - 2030 (Tons)

Table 38 Canada industrial hemp market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 39 Mexico industrial hemp market volume and revenue estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 40 Mexico industrial hemp market volume estimates and forecasts, by source, 2018 - 2030 (Tons)

Table 41 Mexico industrial hemp market revenue estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 42 Mexico industrial hemp market volume estimates and forecasts, by product, 2018 - 2030 (Tons)

Table 43 Mexico industrial hemp market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 44 Mexico industrial hemp market volume estimates and forecasts, by application, 2018 - 2030 (Tons)

Table 45 Mexico industrial hemp market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 46 Europe industrial hemp market volume and revenue estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 47 Europe industrial hemp market volume estimates and forecasts, by source, 2018 - 2030 (Tons)

Table 48 Europe industrial hemp market revenue estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 49 Europe industrial hemp market volume estimates and forecasts, by product, 2018 - 2030 (Tons)

Table 50 Europe industrial hemp market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 51 Europe industrial hemp market volume estimates and forecasts, by application, 2018 - 2030 (Tons)

Table 52 Europe industrial hemp market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 53 UK industrial hemp market volume and revenue estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 54 UK industrial hemp market volume estimates and forecasts, by source, 2018 - 2030 (Tons)

Table 55 UK industrial hemp market revenue estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 56 UK industrial hemp market volume estimates and forecasts, by product, 2018 - 2030 (Tons)

Table 57 UK industrial hemp market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 58 UK industrial hemp market volume estimates and forecasts, by application, 2018 - 2030 (Tons)

Table 59 UK industrial hemp market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 60 Germany industrial hemp market volume and revenue estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 61 Germany industrial hemp market volume estimates and forecasts, by source, 2018 - 2030 (Tons)

Table 62 Germany industrial hemp market revenue estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 63 Germany industrial hemp market volume estimates and forecasts, by product, 2018 - 2030 (Tons)

Table 64 Germany industrial hemp market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 65 Germany industrial hemp market volume estimates and forecasts, by application, 2018 - 2030 (Tons)

Table 66 Germany industrial hemp market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 67 France industrial hemp market volume and revenue estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 68 France industrial hemp market volume estimates and forecasts, by source, 2018 - 2030 (Tons)

Table 69 France industrial hemp market revenue estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 70 France industrial hemp market volume estimates and forecasts, by product, 2018 - 2030 (Tons)

Table 71 France industrial hemp market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 72 France industrial hemp market volume estimates and forecasts, by application, 2018 - 2030 (Tons)

Table 73 France industrial hemp market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 74 Spain industrial hemp market volume and revenue estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 75 Spain industrial hemp market volume estimates and forecasts, by source, 2018 - 2030 (Tons)

Table 76 Spain industrial hemp market revenue estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 77 Spain industrial hemp market volume estimates and forecasts, by product, 2018 - 2030 (Tons)

Table 78 Spain industrial hemp market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 79 Spain industrial hemp market volume estimates and forecasts, by application, 2018 - 2030 (Tons)

Table 80 Spain industrial hemp market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 81 Italy industrial hemp market volume and revenue estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 82 Italy industrial hemp market volume estimates and forecasts, by source, 2018 - 2030 (Tons)

Table 83 Italy industrial hemp market revenue estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 84 Italy industrial hemp market volume estimates and forecasts, by product, 2018 - 2030 (Tons)

Table 85 Italy industrial hemp market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 86 Italy industrial hemp market volume estimates and forecasts, by application, 2018 - 2030 (Tons)

Table 87 Italy industrial hemp market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 88 The Netherlands industrial hemp market volume and revenue estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 89 The Netherlands industrial hemp market volume estimates and forecasts, by source, 2018 - 2030 (Tons)

Table 90 The Netherlands industrial hemp market revenue estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 91 The Netherlands industrial hemp market volume estimates and forecasts, by product, 2018 - 2030 (Tons)

Table 92 The Netherlands industrial hemp market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 93 The Netherlands industrial hemp market volume estimates and forecasts, by application, 2018 - 2030 (Tons)

Table 94 The Netherlands industrial hemp market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 95 Asia Pacific industrial hemp market volume and revenue estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 96 Asia Pacific industrial hemp market volume estimates and forecasts, by source, 2018 - 2030 (Tons)

Table 97 Asia Pacific industrial hemp market revenue estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 98 Asia Pacific industrial hemp market volume estimates and forecasts, by product, 2018 - 2030 (Tons)

Table 99 Asia Pacific industrial hemp market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 100 Asia Pacific industrial hemp market volume estimates and forecasts, by application, 2018 - 2030 (Tons)

Table 101 Asia Pacific industrial hemp market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 102 China industrial hemp market volume and revenue estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 103 China industrial hemp market volume estimates and forecasts, by source, 2018 - 2030 (Tons)

Table 104 China industrial hemp market revenue estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 105 China industrial hemp market volume estimates and forecasts, by product, 2018 - 2030 (Tons)

Table 106 China industrial hemp market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 107 China industrial hemp market volume estimates and forecasts, by application, 2018 - 2030 (Tons)

Table 108 China industrial hemp market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 109 India industrial hemp market volume and revenue estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 110 India industrial hemp market volume estimates and forecasts, by source, 2018 - 2030 (Tons)

Table 111 India industrial hemp market revenue estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 112 India industrial hemp market volume estimates and forecasts, by product, 2018 - 2030 (Tons)

Table 113 India industrial hemp market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 114 India industrial hemp market volume estimates and forecasts, by application, 2018 - 2030 (Tons)

Table 115 India industrial hemp market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 116 Japan industrial hemp market volume and revenue estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 117 Japan industrial hemp market volume estimates and forecasts, by source, 2018 - 2030 (Tons)

Table 118 Japan industrial hemp market revenue estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 119 Japan industrial hemp market volume estimates and forecasts, by product, 2018 - 2030 (Tons)

Table 120 Japan industrial hemp market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 121 Japan industrial hemp market volume estimates and forecasts, by application, 2018 - 2030 (Tons)

Table 122 Japan industrial hemp market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 123 Australia industrial hemp market volume and revenue estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 124 Australia industrial hemp market volume estimates and forecasts, by source, 2018 - 2030 (Tons)

Table 125 Australia industrial hemp market revenue estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 126 Australia industrial hemp market volume estimates and forecasts, by product, 2018 - 2030 (Tons)

Table 127 Australia industrial hemp market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 128 Australia industrial hemp market volume estimates and forecasts, by application, 2018 - 2030 (Tons)

Table 129 Australia industrial hemp market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 130 New Zealand industrial hemp market volume and revenue estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 131 New Zealand industrial hemp market volume estimates and forecasts, by source, 2018 - 2030 (Tons)

Table 132 New Zealand industrial hemp market revenue estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 133 New Zealand industrial hemp market volume estimates and forecasts, by product, 2018 - 2030 (Tons)

Table 134 New Zealand industrial hemp market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 135 New Zealand industrial hemp market volume estimates and forecasts, by application, 2018 - 2030 (Tons)

Table 136 New Zealand industrial hemp market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 137 Central & South America industrial hemp market volume and revenue estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 138 Central & South America industrial hemp market volume estimates and forecasts, by source, 2018 - 2030 (Tons)

Table 139 Central & South America industrial hemp market revenue estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 140 Central & South America industrial hemp market volume estimates and forecasts, by product, 2018 - 2030 (Tons)

Table 141 Central & South America industrial hemp market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 142 Central & South America industrial hemp market volume estimates and forecasts, by application, 2018 - 2030 (Tons)

Table 143 Central & South America industrial hemp market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 144 Brazil industrial hemp market volume and revenue estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 145 Brazil industrial hemp market volume estimates and forecasts, by source, 2018 - 2030 (Tons)

Table 146 Brazil industrial hemp market revenue estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 147 Brazil industrial hemp market volume estimates and forecasts, by product, 2018 - 2030 (Tons)

Table 148 Brazil industrial hemp market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 149 Brazil industrial hemp market volume estimates and forecasts, by application, 2018 - 2030 (Tons)

Table 150 Brazil industrial hemp market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

Table 151 Middle East & Africa industrial hemp market volume and revenue estimates and forecasts, 2018 - 2030 (Tons) (USD Million)

Table 152 Middle East & Africa industrial hemp market volume estimates and forecasts, by source, 2018 - 2030 (Tons)

Table 153 Middle East & Africa industrial hemp market revenue estimates and forecasts, by source, 2018 - 2030 (USD Million)

Table 154 Middle East & Africa industrial hemp market volume estimates and forecasts, by product, 2018 - 2030 (Tons)

Table 155 Middle East & Africa industrial hemp market revenue estimates and forecasts, by product, 2018 - 2030 (USD Million)

Table 156 Middle East & Africa industrial hemp market volume estimates and forecasts, by application, 2018 - 2030 (Tons)

Table 157 Middle East & Africa industrial hemp market revenue estimates and forecasts, by application, 2018 - 2030 (USD Million)

List of Figures

Fig. 1 Market snapshot

Fig. 2 Market trends & outlook

Fig. 3 Industrial hemp - Market segmentation

Fig. 4 Industrial hemp - Value chain analysis

Fig. 5 Industrial hemp - Market dynamics

Fig. 6 Market driver analysis

Fig. 7 U.S. hemp import, 2018 - 2023 (Metric Tons)

Fig. 8 Market restraint analysis

Fig. 9 Industrial hemp market - Porters

Fig. 10 Industrial hemp market - PESTEL analysis

Fig. 11 Industrial hemp: Product movement analysis, 2023 & 2030

Fig. 12 Industrial hemp market: Application movement analysis, 2023 & 2030

Fig. 13 Industrial hemp market: Regional movement analysis, 2023 & 2030

What questions do you have? Get quick response from our industry experts. Request a Free Consultation

Market Segmentation

The global hemp market is driven by the rising demand from industries such as agriculture, textiles, personal care, recycling, automotive, furniture, food & beverage, paper, and construction materials. Growing demand for hemp products including fiber, seed, stalks, hurds, and oils from the application above industries is expected to drive the market over the forecast period.

Hemp fibers are used in fabrics and textiles, yarns and spun fibers, paper, home furnishing, carpeting, construction and insulation materials, auto parts, and composites. Hemp hurd obtained from hemp stalks is used in animal bedding, paper, and oil absorbents. Hemp oil is used in shampoos, soaps, lotions, bath gels, and other cosmetics. Hemp-based personal care products are expected to drive market growth over the forecast period because of hemp oil's high and favorably balanced essential fatty acid content, making it an ideal ingredient for body care products. Hemp oil treats many skin conditions such as acne, psoriasis, and eczema. According to California-based Hemp Industries Association (HIA), USD 147 million worth of hemp-based personal care products were distributed in the U.S. in 2015 and are expected to remain a vital part of the overall market growth over the forecast period.

Hemp is also used in medicinal and therapeutic products and nutritional supplements, including pharmaceuticals. The high dietary values and beneficial fatty acid and protein profile of hemp drive the demand for hemp products in the market. Hemp oil contains fatty acids with a 3:1 ratio of omega-6 and omega-3 acids. Hemp oil contains about 80% of the essential fatty acids, including linoleic acid, omega-3, omega-6, and alpha-linoleic acid, which the body requires to build healthy cells and maintain brain and nerve function.

In comparison with other bast fibers such as kenaf, flax, jute, or ramie, hemp fiber has excellent length, durability, strength, absorbency, anti-mildew, and anti-microbial properties. The high absorbency of hemp fiber benefits oil and gas cleanup, livestock bedding, and personal hygiene market. Industrial hemp's high tensile strength, strength-to-weight ratio, and flexural strength offer desired benefits in bio-composites for automotive parts, fiberboard, aerospace, and packaging. Furthermore, the demand for hemp from the textile, paper, and building materials markets is growing due to its favorable acoustic and aesthetic properties.

Industrial hemp production is associated with several agricultural and environmental benefits. With its fast growth period of 120-150 days and significant biomass yield, hemp enables efficient agricultural land use. It is helpful in carbon sequestration as it yields a large amount of biomass along with providing a valuable break in crop rotation. Hemp can be grown in various soil types and climatic conditions. In addition, the crop grows in very tightly-spaced areas, enabling more profits for farmers with small lands. The crop is naturally weed-suppressing and disease-free and, thus, can be cultivated without the need for most pesticides, herbicides, or fungicides, which protects the soil from the hazardous effects of these chemicals. Because of its resiliency, it is used as a natural method to clean up soil pollution using phytoremediation, which is used to extract toxins and pollutants from the groundwater and soil harmlessly. In addition to the direct benefits of hemp in reducing the environmental impact of crop production, the products manufactured from hemp are eco-friendly, renewable, and associated with less harmful preparation methods. For instance, paper produced from hemp fiber requires less chemicals for processing than paper made from wood pulps.

Industrial hemp is a highly regulated crop worldwide; licenses from different country and state authorities are required to grow, process, distribute, and use hemp products. Acts such as the Industrial Hemp Regulatory Act, Controlled Substances Act of 1970, Agricultural Act of 2014, 2014 Farm Bill, and Industrial Hemp Act 2017 control industrial hemp production, possession, sale, transportation, and delivery.

Industrial hemp production in the U.S. faces additional obstacles from strict governmental drug policies and concerns about the impact of industrial hemp on the illegal marijuana market. Only varieties of industrial hemp named in the list of approved cultivars published by Health Canada are approved for planting in Canada. These varieties are known to produce plants containing less than 0.3% THC under normal conditions. Furthermore, the Canadian government only gives licenses to grow industrial hemp for grains or fibers for one calendar year for crops of four hectares or more, and if cultivating for pedigreed seed, not less than one hectare. Finola, CFX-2, X 59, CRS-1, and CFX-1 are the most common approved varieties being contracted and grown in Canada.

Important hemp-producing countries include China, Hungary, Romania, Poland, France, and Italy. Canada, the UK, and Germany resumed commercial production in the 1990s. The UK produces hemp mainly for its use in horse bedding; however, companies in Canada, the UK, the U.S., and Germany, among many others, are processing hemp seed into a growing range of food products and cosmetics. Although these countries are producing and consuming significant amounts of hemp while liberalizing regulations, they are also promoting the consumption of alternative fibers such as kenaf, flax, chia, and jute, which are legal across the world and have characteristics similar to that of hemp fibers, thereby restricting market growth.

This section will provide insights into the contents included in this industrial hemp market report and help gain clarity on the structure of the report to assist readers in navigating smoothly.

What questions do you have? Get quick response from our industry experts. Request a Free Consultation

A three-pronged approach was followed for deducing the industrial hemp market estimates and forecasts. The process has three steps: information procurement, analysis, and validation. The whole process is cyclical, and steps repeat until the estimates are validated. The three steps are explained in detail below:

Information procurement: Information procurement is one of the most extensive and important stages in our research process, and quality data is critical for accurate analysis. We followed a multi-channel data collection process for industrial hemp market to gather the most reliable and current information possible.

Analysis: We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilized different methods of industrial hemp market data depending on the type of information we’re trying to uncover in our research.

Market formulation and validation : We mine the data collected to establish baselines for forecasting, identify trends and opportunities, gain insight into consumer demographics and drivers, and so much more. We utilize different methods of data analysis depending on the type of information we’re trying to uncover in our research.

The industrial hemp market was categorized into three segments, namely product (Seeds, Fiber, Shivs), application (Animal Care, Textiles, Automotive, Furniture, Food & Beverages, Paper, Construction Materials, Personal Care), and region (North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa)

The industrial hemp market was segmented into product, application, and regions. The demand at a segment level was deduced using a funnel method. Concepts like the TAM, SAM, SOM, etc., were put into practice to understand the demand. We at GVR deploy three methods to deduce market estimates and determine forecasts. These methods are explained below:

All three above-mentioned market research methodologies were applied to arrive at regional-level conclusions. The regions were then summed up to form the global market.

The industrial hemp market was analyzed via companies operating in the sector. Analyzing these companies and cross-referencing them to the demand equation helped us validate our assumptions and conclusions. Key market players analyzed include:

Supply Side Estimates

Demand side estimates

GVR strives to procure the latest and unique information for reports directly from industry experts, which gives it a competitive edge. Quality is of utmost importance to us, therefore every year we focus on increasing our experts’ panel. Primary interviews are one of the critical steps in identifying recent market trends and scenarios. This process enables us to justify and validate our market estimates and forecasts to our clients. With more than 8,000 reports in our database, we have connected with some key opinion leaders across various domains, including healthcare, technology, consumer goods, and the chemical sector. Our process starts with identifying the right platform for a particular type of report, i.e., emails, LinkedIn, seminars, or telephonic conversation, as every report is unique and requires a differentiated approach.

We send out questionnaires to different experts from various regions/ countries, which is dependent on the following factors:

The time to start receiving responses from industry experts varies based on how niche or well-penetrated the market is. Our reports include a detailed chapter on the KoL opinion section, which helps our clients understand the perspective of experts already in the market space.

What questions do you have? Get quick response from our industry experts. Request a Free Consultation